Depreciation On Mobile As Per Companies Act 2013 . Depreciation as per companies act, 2013. 127 rows ca sandeep kanoi. Depreciation is a measure of loss. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. There are three methods to calculate depreciation as per companies act 2013: In this article we have compiled depreciation rates under companies act 2013 under written down value.

from www.slideserve.com

Depreciation as per companies act, 2013. 127 rows ca sandeep kanoi. There are three methods to calculate depreciation as per companies act 2013: Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. In this article we have compiled depreciation rates under companies act 2013 under written down value. Depreciation is a measure of loss.

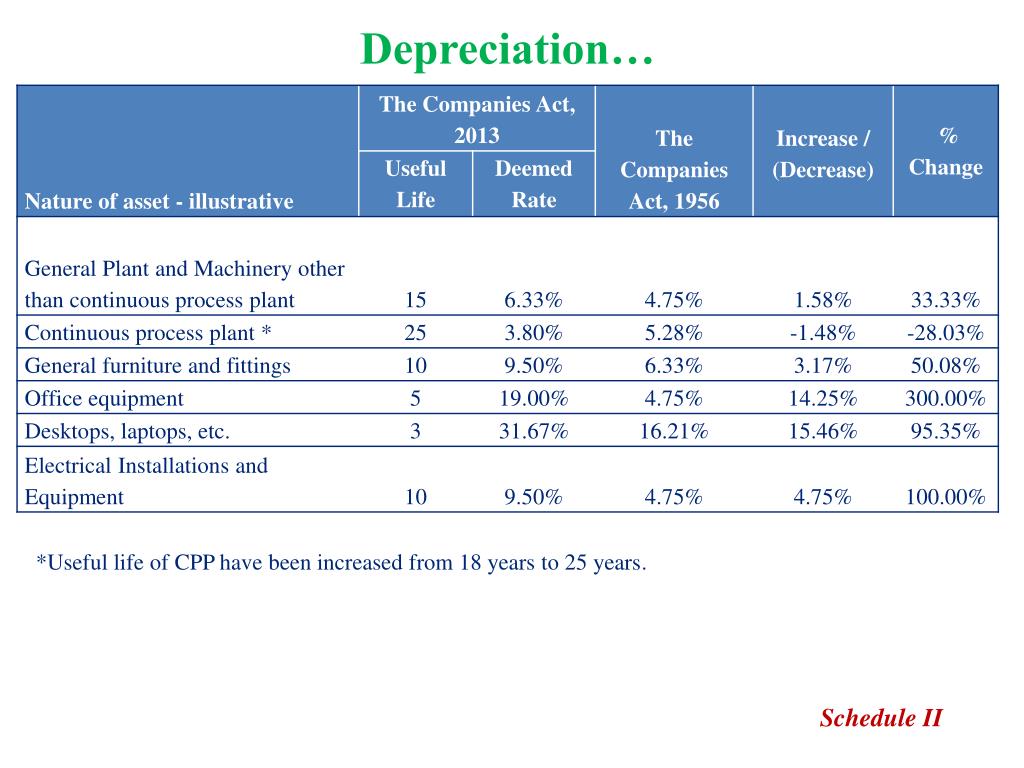

PPT THE COMPANIES ACT, 2013 ACCOUNTS & AUDIT PowerPoint Presentation

Depreciation On Mobile As Per Companies Act 2013 In this article we have compiled depreciation rates under companies act 2013 under written down value. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. Depreciation is a measure of loss. 127 rows ca sandeep kanoi. Depreciation as per companies act, 2013. In this article we have compiled depreciation rates under companies act 2013 under written down value. There are three methods to calculate depreciation as per companies act 2013:

From bceweb.org

Depreciation Chart As Per Companies Act 2013 A Visual Reference of Depreciation On Mobile As Per Companies Act 2013 There are three methods to calculate depreciation as per companies act 2013: Depreciation as per companies act, 2013. 127 rows ca sandeep kanoi. In this article we have compiled depreciation rates under companies act 2013 under written down value. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. Depreciation is. Depreciation On Mobile As Per Companies Act 2013.

From bceweb.org

Depreciation Chart As Per Companies Act 2013 A Visual Reference of Depreciation On Mobile As Per Companies Act 2013 Depreciation is a measure of loss. There are three methods to calculate depreciation as per companies act 2013: In this article we have compiled depreciation rates under companies act 2013 under written down value. Depreciation as per companies act, 2013. 127 rows ca sandeep kanoi. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a. Depreciation On Mobile As Per Companies Act 2013.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Depreciation On Mobile As Per Companies Act 2013 In this article we have compiled depreciation rates under companies act 2013 under written down value. Depreciation as per companies act, 2013. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. 127 rows ca sandeep kanoi. Depreciation is a measure of loss. There are three methods to calculate depreciation as. Depreciation On Mobile As Per Companies Act 2013.

From www.slideserve.com

PPT THE COMPANIES ACT, 2013 ACCOUNTS & AUDIT PowerPoint Presentation Depreciation On Mobile As Per Companies Act 2013 There are three methods to calculate depreciation as per companies act 2013: Depreciation as per companies act, 2013. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. In this article we have compiled depreciation rates under companies act 2013 under written down value. Depreciation is a measure of loss. 127. Depreciation On Mobile As Per Companies Act 2013.

From minga.turkrom2023.org

Depreciation Chart As Per Companies Act 2013 Minga Depreciation On Mobile As Per Companies Act 2013 There are three methods to calculate depreciation as per companies act 2013: Depreciation is a measure of loss. In this article we have compiled depreciation rates under companies act 2013 under written down value. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. 127 rows ca sandeep kanoi. Depreciation as. Depreciation On Mobile As Per Companies Act 2013.

From khatabook.com

Depreciation Rate as Per Companies Act How to Use Depreciation Calculator Depreciation On Mobile As Per Companies Act 2013 127 rows ca sandeep kanoi. There are three methods to calculate depreciation as per companies act 2013: Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. Depreciation as per companies act, 2013. Depreciation is a measure of loss. In this article we have compiled depreciation rates under companies act 2013. Depreciation On Mobile As Per Companies Act 2013.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Depreciation On Mobile As Per Companies Act 2013 Depreciation as per companies act, 2013. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. Depreciation is a measure of loss. In this article we have compiled depreciation rates under companies act 2013 under written down value. 127 rows ca sandeep kanoi. There are three methods to calculate depreciation as. Depreciation On Mobile As Per Companies Act 2013.

From haipernews.com

How To Calculate Depreciation Under Companies Act Haiper Depreciation On Mobile As Per Companies Act 2013 There are three methods to calculate depreciation as per companies act 2013: Depreciation is a measure of loss. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. In this article we have compiled depreciation rates under companies act 2013 under written down value. 127 rows ca sandeep kanoi. Depreciation as. Depreciation On Mobile As Per Companies Act 2013.

From studycafe.in

Depreciation Chart as per Companies Act 2013 for FY 1819 Depreciation On Mobile As Per Companies Act 2013 In this article we have compiled depreciation rates under companies act 2013 under written down value. 127 rows ca sandeep kanoi. Depreciation as per companies act, 2013. Depreciation is a measure of loss. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. There are three methods to calculate depreciation as. Depreciation On Mobile As Per Companies Act 2013.

From www.youtube.com

How To Calculate Depreciation As Per Companies ACT 2013 Depreciation Depreciation On Mobile As Per Companies Act 2013 In this article we have compiled depreciation rates under companies act 2013 under written down value. Depreciation is a measure of loss. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. Depreciation as per companies act, 2013. There are three methods to calculate depreciation as per companies act 2013: 127. Depreciation On Mobile As Per Companies Act 2013.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Depreciation On Mobile As Per Companies Act 2013 Depreciation as per companies act, 2013. There are three methods to calculate depreciation as per companies act 2013: 127 rows ca sandeep kanoi. In this article we have compiled depreciation rates under companies act 2013 under written down value. Depreciation is a measure of loss. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a. Depreciation On Mobile As Per Companies Act 2013.

From issuu.com

A Practical Guide to Depreciation under Companies Act, 2013 by Depreciation On Mobile As Per Companies Act 2013 Depreciation is a measure of loss. In this article we have compiled depreciation rates under companies act 2013 under written down value. 127 rows ca sandeep kanoi. Depreciation as per companies act, 2013. There are three methods to calculate depreciation as per companies act 2013: Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a. Depreciation On Mobile As Per Companies Act 2013.

From www.udyamica.com

Depreciation rates as per Companies Act 2013 for new assets Depreciation On Mobile As Per Companies Act 2013 127 rows ca sandeep kanoi. There are three methods to calculate depreciation as per companies act 2013: Depreciation as per companies act, 2013. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. In this article we have compiled depreciation rates under companies act 2013 under written down value. Depreciation is. Depreciation On Mobile As Per Companies Act 2013.

From gstguntur.com

Depreciation Rate Chart as per Companies Act 2013 with Related Law Depreciation On Mobile As Per Companies Act 2013 There are three methods to calculate depreciation as per companies act 2013: In this article we have compiled depreciation rates under companies act 2013 under written down value. Depreciation as per companies act, 2013. 127 rows ca sandeep kanoi. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. Depreciation is. Depreciation On Mobile As Per Companies Act 2013.

From haipernews.com

How To Calculate Depreciation As Per Companies Act Haiper Depreciation On Mobile As Per Companies Act 2013 There are three methods to calculate depreciation as per companies act 2013: In this article we have compiled depreciation rates under companies act 2013 under written down value. 127 rows ca sandeep kanoi. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. Depreciation as per companies act, 2013. Depreciation is. Depreciation On Mobile As Per Companies Act 2013.

From www.youtube.com

Depreciation Chart as per Companies Act 2013 Calculate rates of Depreciation On Mobile As Per Companies Act 2013 Depreciation as per companies act, 2013. Depreciation is a measure of loss. 127 rows ca sandeep kanoi. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. In this article we have compiled depreciation rates under companies act 2013 under written down value. There are three methods to calculate depreciation as. Depreciation On Mobile As Per Companies Act 2013.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Depreciation On Mobile As Per Companies Act 2013 There are three methods to calculate depreciation as per companies act 2013: In this article we have compiled depreciation rates under companies act 2013 under written down value. Depreciation is a measure of loss. Depreciation as per companies act, 2013. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. 127. Depreciation On Mobile As Per Companies Act 2013.

From khatabook.com

Depreciation Rate as Per Companies Act How to Use Depreciation Calculator Depreciation On Mobile As Per Companies Act 2013 127 rows ca sandeep kanoi. Depreciation is a measure of loss. Depreciation as per companies act, 2013. In this article we have compiled depreciation rates under companies act 2013 under written down value. Under the companies act, 2013 (2013 act), depreciation accounting assumes a new order, from a regime of prescription based. There are three methods to calculate depreciation as. Depreciation On Mobile As Per Companies Act 2013.